Bequest from Your Will

Including the ASPCA in your will or trust is a meaningful way to help us continue to serve animals in need. Many of our programs and services have benefitted from individuals who had the foresight to include the ASPCA in their estate plans.

Ways You Can Give Through a Will or Trust:

- Leave a specific dollar amount or asset to the ASPCA.

- Designate a percentage of your estate to be given through your will or living trust.

- Give only the remainder, or residue, of your estate, or that which remains after bequests to loved ones have been made.

The following is an example of suggested language to include in your will/trust:

"I give and bequeath to The American Society for the Prevention of Cruelty to Animals, a not-for-profit corporation, with principal offices presently located at 424 East 92nd Street, New York, NY, 10128, the sum of , or _______% of my estate, to be used for the accomplishment of its general purpose (or for a specific purpose as indicated)".

Ways You Can Give Through Other Means:

- An outright gift of cash

- Securities

- Personal property

- Real estate (real estate is accepted on a case-by-case basis with minimum valuation considerations and a written appraisal)

You may designate your bequest in two ways:

- For the general purposes of the ASPCA (an unrestricted bequest)

- To be used to support a particular program (a restricted bequest)

The material presented in this website is intended as general educational information on the topics discussed herein and should not be interpreted as legal, financial or tax advice. Please seek the specific advice of your tax advisor, attorney, and/or financial planner to discuss the application of these topics to your individual situation.

Charitable Gift Annuity

A gift annuity is a contractual agreement in which, in exchange for a minimum gift of $10,000, the ASPCA will make payments to you, another person, or two people for life. Use our calculator to see the benefits of a Charitable Gift Annuity.

Individuals aged 60 or older are eligible for immediate payment annuities. Payments can also be deferred to a future date, making gift annuities an excellent retirement vehicle. The gift can be in cash or marketable securities.

The minimum age for those entering into a Deferred Payment Charitable Gift Annuity contract is 50, and the minimum age for payments to begin is 60. People age 60 or older can defer payments for at least one year after the annuity is established.

Establishing a gift annuity accomplishes two things: a contract is made for you, the donor (and another individual if you choose) to receive a fixed payment for life, and a gift is made to the ASPCA. Since a portion of the amount given for a gift annuity will be used for charitable purposes, the donor is entitled to a federal (and perhaps state) income tax deduction the year the gift is made.

The contributed irrevocable gift becomes an asset of the ASPCA and the payments are a general obligation of the organization. The annuity is backed by the full assets of the ASPCA, and the funds are separately invested according to conservative and disciplined financial standards.

For a period of years, a portion of each payment received is tax-free. This further increases the after-tax dollars available to the donor for spending or investing. An annuity funded with appreciated securities has even more advantages: The gain allocated to the gift portion is not subject to the capital gains tax, and the portion of the gain to be recognized can be spread over the expected term of the contract.

The material presented in this website is intended as general educational information on the topics discussed herein and should not be interpreted as legal, financial or tax advice. Please seek the specific advice of your tax advisor, attorney, and/or financial planner to discuss the application of these topics to your individual situation.

Retirement Assets

Retirement assets are one of the most beneficial gifts you can give to the ASPCA. These funds grow tax-free until the time of withdrawal. With the innovative use of these assets, you are able to contribute generously to the ASPCA as well as provide for your loved ones. Many taxes on these plans can be avoided or reduced through a carefully planned charitable gift.

Consider these charitable approaches:

Outright gift through beneficiary designation.

You can name the ASPCA as the beneficiary or contingent beneficiary of your retirement assets after your lifetime. When a retirement account is left to a charity, the organization does not pay any income tax whereas your heirs may pay income tax if they inherit your retirement funds. Your retirement plan’s administrator can provide a beneficiary form for you to name the ASPCA as your sole or partial beneficiary.

Charitable remainder trust after a donor's lifetime.

You can name a trust as the ultimate beneficiary of excess or unused retirement assets. After your lifetime, the trust can provide income to heirs for a period of years, after which time the trust monies can fund charitable endeavors. Since it is a charitable trust, there is more money available to generate income for heirs.

The material presented in this website is intended as general educational information on the topics discussed herein and should not be interpreted as legal, financial or tax advice. Please seek the specific advice of your tax advisor, attorney, and/or financial planner to discuss the application of these topics to your individual situation.

Life Insurance

Life insurance is often overlooked as an asset that you can use to make gifts to the ASPCA. There are a number of ways to support the ASPCA’s many programs with an insurance-related gift.

Add a beneficiary to your policy.

It is relatively simple to make a change to the beneficiary/beneficiaries of your insurance policy without changing your will or other aspects of your estate plan. Just ask your insurance company for a form that will allow you to make the ASPCA a beneficiary of your insurance policy.

Give a paid-up policy.

You can transfer ownership of a paid-up life insurance policy to the ASPCA. After the transfer, the ASPCA can elect to either cash in the policy right away or keep the policy and receive the death benefit later. You would receive an immediate income tax deduction for either the cash surrender value or the basis (usually the cost), whichever is less.

Making the ASPCA the owner and beneficiary.

You can take out a policy and make the ASPCA the owner and beneficiary of the policy. Premium payments can be made by you directly to the insurance company or by the ASPCA, by way of your annual gift to the organization. Whichever way the premiums are paid, you can take an income tax deduction.

The material presented in this website is intended as general educational information on the topics discussed herein and should not be interpreted as legal, financial or tax advice. Please seek the specific advice of your tax advisor, attorney, and/or financial planner to discuss the application of these topics to your individual situation.

Charitable Remainder Trust

A Charitable Remainder Trust (CRT) is a life-income arrangement that provides you and/or other beneficiaries with a stream of income for life or for a period of years. After the trust terminates, the principal, or “remainder interest,” goes to the ASPCA. Unlike other life-income arrangements, CRTs are separately invested and managed trusts. Please note that the ASPCA does not manage these trusts for donors.

This is the most flexible of life-income plans, and a powerful way for you to benefit along with your heirs and the ASPCA. Some versions of CRTs can be funded with closely held stock, partnership interests, real estate, and in some instances, tangible personal property such as works of art. You can choose to receive a variable or fixed income (beginning immediately) for life or a term of years. There is no limitation on the number of beneficiaries of a CRT.

CRT Benefits:

- When appreciated assets are donated to the trust, they can be sold without incurring capital gains tax, allowing the entire proceeds from the sale to be reinvested.

- You can receive a charitable income tax deduction in the year the gift is made, with an additional five years to carry over any unused deduction.

- You can add to certain types of CRTs at any time.

- Through reinvestment within the trust, you can achieve diversification of a previously concentrated asset.

- Any assets that you contribute to a CRT are immediately removed from your estate, reducing your estate tax exposure.

Basic Types of CRTs:

- Unitrust (CRUT): This type of trust pays a variable income based on a fixed percentage (for example, between 5 and 6 percent) of the trust assets, revalued once each year. One advantage of a unitrust is that your income can increase as the trust principal grows over time. This type of CRT allows you to make additional contributions at any time.

- Annuity Trust (CRAT): This type of trust pays a fixed annual income that is determined when the trust is established. The annuity trust is often preferred by those who are interested in the security of a constant return. See how a Charitable Remainder Trust will benefit you with our gift calculator .

The material presented in this website is intended as general educational information on the topics discussed herein and should not be interpreted as legal, financial or tax advice. Please seek the specific advice of your tax advisor, attorney, and/or financial planner to discuss the application of these topics to your individual situation.

Other Ways of Planned Giving

"Payable on death"(POD) or "Transfer on Death"(TOD) accounts name a beneficiary to receive the proceeds upon your passing. You do not have to change your will or work with an attorney or accountant. There are no fees to arrange such a gift. You simply complete the beneficiary form given to you by the financial institution with the information below. You retain complete control over the funds or assets in the account while you are living, and these gifts are completely revocable.

Organization Information:

Legal Name: American Society for the Prevention of Cruelty to Animals (ASPCA)

Principal Address: 424 East 92nd Street, New York, NY 10128

Telephone: (212) 876-7700

Federal Tax ID # 13-1623829

Although it is not possible to make a lifetime charitable gift of a savings bond without first paying the tax on the interest earned, it does make an excellent asset to bequeath to the ASPCA. That’s because savings bonds generate “income in respect of a decedent.” That means if you die owning them, the accumulated interest is taxed before your heirs inherit them. However, if they are left to an organization like the ASPCA, that tax is not due. We suggest that you check with your advisors about the best way to bequeath your savings bonds to the ASPCA.

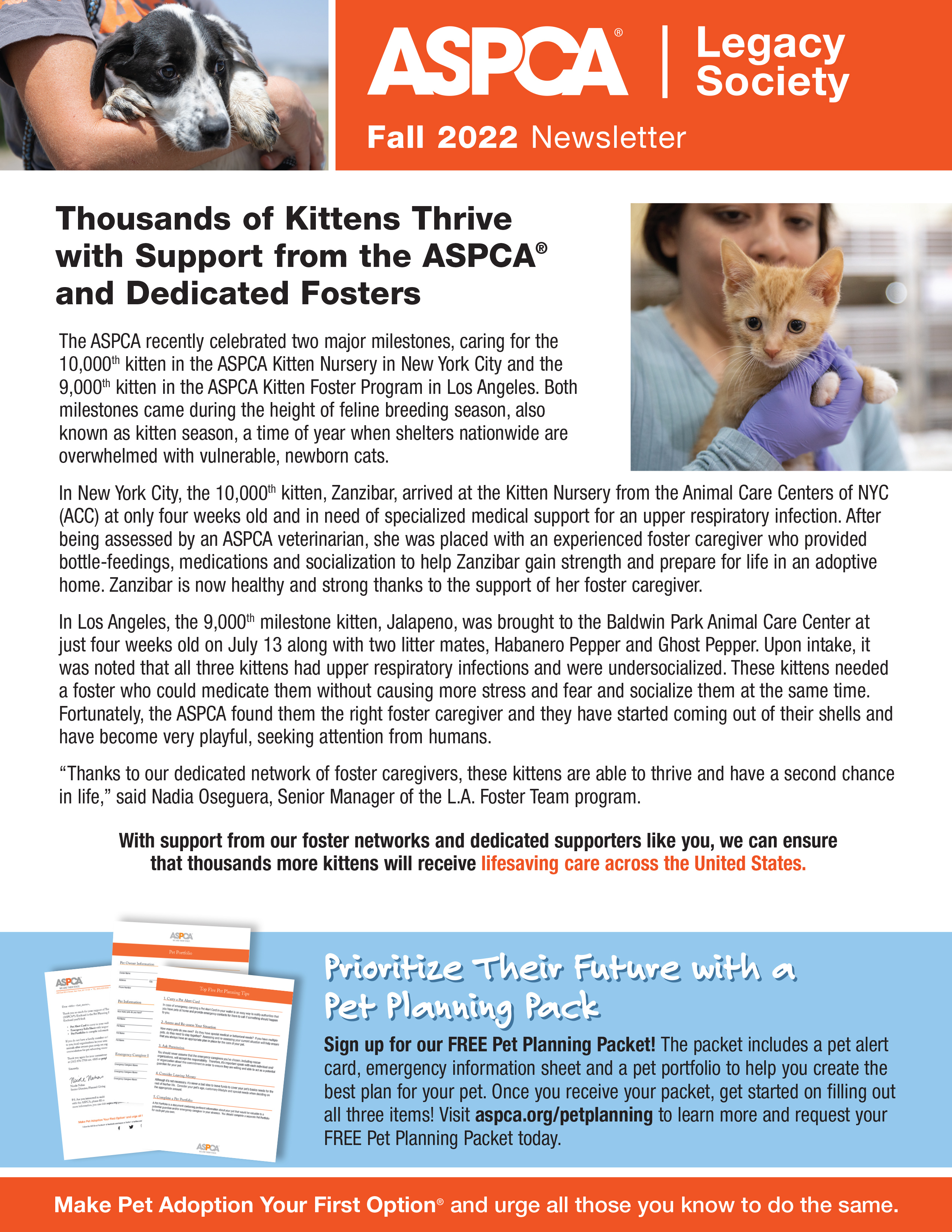

Featured Highlights

ASPCA Legacy Society

The ASPCA Legacy Society was established to recognize and thank those of you who have included the ASPCA in your estate plans either through your will, trust, retirement or life insurance plans, bank accounts, or life income gift such as a charitable gift annuity. Through your thoughtfulness, you have made a timeless commitment to continue the work of the ASPCA to combat animal cruelty for years to come.

- Including us with a gift in your will or revocable trust

- A life-income gift that names the ASPCA as a remainder beneficiary, such as a charitable remainder trust, or a charitable gift annuity

- A gift or assignment of qualified retirement plan assets, such as an IRA, 401(k) or 403(b)

- A gift of life insurance

- As a beneficiary of a bank account

- Bi-annual Legacy Society Newsletter

- ASPCA Action magazine

- An opportunity to be a part of our "Legacy Legends," stories about how and why other dedicated donors have decided to join the Legacy Society

- ASPCA Calendar

- Personal tour of the ASPCA Adoption Center in New York City

If you have already included the ASPCA in a bequest or other planned gift, we hope you will let us know . Your willingness to be listed as a member of the ASPCA Legacy Society encourages others to follow your example. We acknowledge and respect those who wish to remain anonymous, but we urge you to let us know of your plans on a confidential basis, as it allows the ASPCA to plan for the future.

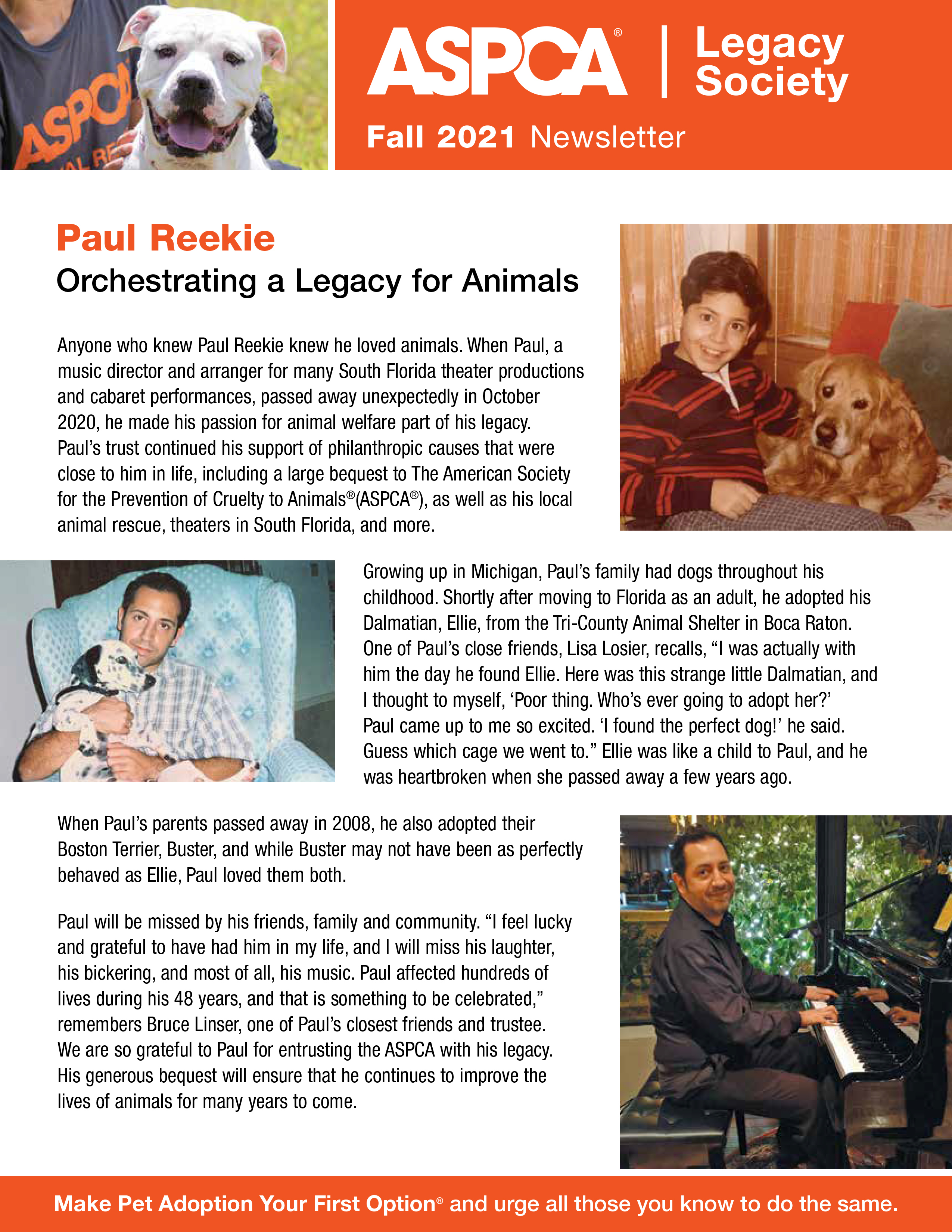

Legacy Society Newsletter

Spring 2023

[PDF]

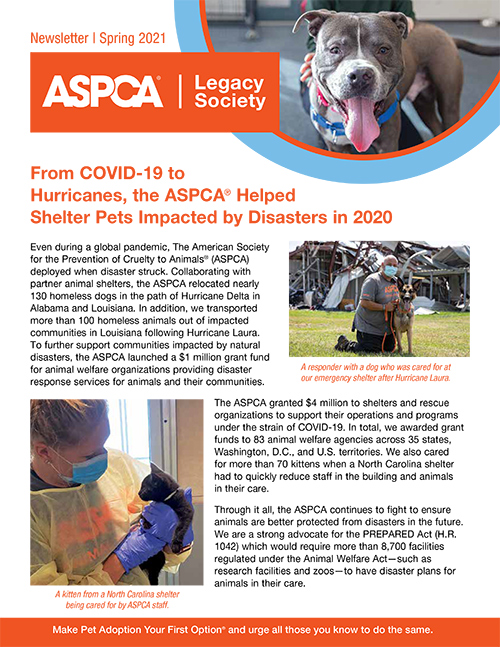

Legacy Society Newsletter

Fall 2022

[PDF]

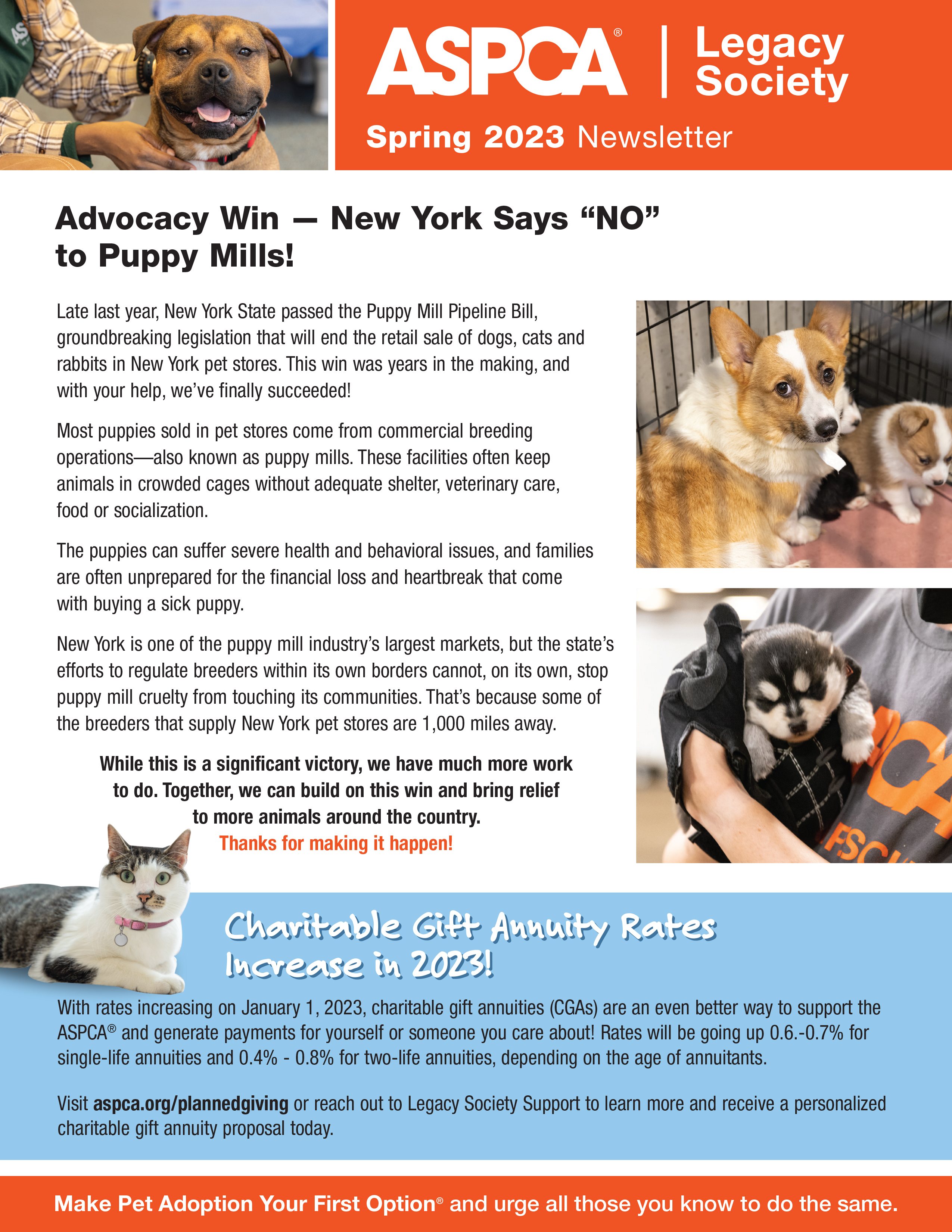

Legacy Society Newsletter

Spring 2022

[PDF]